Barclays' Structured Product Linked to a Basket of ETFs and Indexes

(Mar 2013)

RISK.net recently posted an article entitled "IWM urges investors to think about risk-adjusted returns" in the structured products portion of their website. The article describes in detail a Barclays product for which Institute for WealthManagement, LLC (IWM) served as the basket selection agent. Interestingly, the basket is composed mostly of ETFs, which have been appearing in structured products more frequently as the ETF industry itself has become more mature. IWM's Matt Medeiros talked...

Persistence and Mean Reversion in Market Data

(Mar 2013)

Jason Voss at the CFA Institute has recently written a very interesting series of posts on the Hurst exponent, which is "a method for detecting persistence, randomness, or mean reversion in financial markets." The Hurst exponent measures the degree to which a signal depends on previous values--a phenomenon known as autocorrelation--and specifically whether values tend to 'switch' (e.g., high values followed by low values) or 'persist' (e.g., high values followed by other high values). Jason...

SEC Examination Priorities 2013

(Feb 2013)

Last week, the Securities and Exchange Commission announced their examination priorities for 2013 "to communicate with investors and registrants about areas that are perceived by the staff to have heightened risk, and to support the SEC's mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation."

For those that are unfamiliar, SEC staff conducts examinations of SEC registrants through their regional offices and headquarters

to determine...

How Big of an Effect Does Securities Lending Have on ETF Returns?

(Feb 2013)

We earlier posted an analysis that compared ETF returns to their stated index net of fees for funds that lend securities and those that do not. IndexUniverse subsequently suggested an approach with methodological differences from our original work and we wanted to address some of those differences here.

For our sample, we used Bloomberg's ETF function to collect all US-domiciled, USD-denominated exchange-traded funds and removed any with active trading strategies, leverage, or inception dates...

Securities Lending by ETFs

(Feb 2013)

One of the most contentious but least understood aspects of the stock market is short selling. Short selling refers to selling a stock that you do not own at current market prices, with the hopes that the stock will go down in price. The stock can be purchased in the market at any time to close out the position and, if the stock has decreased in price, the short-seller will realize a profit. Obviously, the only way to accomplish this is by borrowing that stock from someone else.

Typically,...

Chinese Markets are Closed--So What Happens to China-based ETFs in the US?

(Feb 2013)

Happy Chinese New Year! Markets were closed in many Asian countries last week, while US markets remained open. As noted by several commentators, this means that while US ETFs that hold Chinese equities were actively traded, their underlying assets were not. So what does this mean for China-based ETFs traded in the US?

First, it's important to note how ETFs relate to their underlying assets. Essentially, ETF shares can be created by certain traders (called authorized participants) by buying...

Structured Certificates of Deposit Week

(Feb 2013)

Over the past several months, we have noticed more and more bank deposits that resemble structured products. These products go by various names: market-linked certificates of deposit, equity-linked certificates of deposit, contingent interest certificates of deposits, etc. For parsimony, we refer to these types of products as "structured CDs" or simply "SCDs".

We think structured CDs are a very significant development, as they can be designed to provide highly complex exposure, are almost...

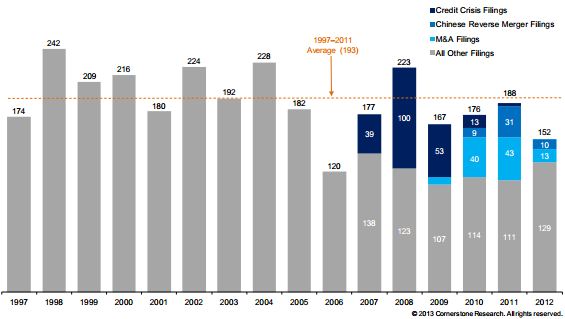

Securities Class Action Filings Decrease in 2012

(Feb 2013)

Earlier this year, Cornerstone Research released 2012 review of Securities Class Action Filings in conjunction with the Stanford Law School -- see the press release. The report notes that the number of federal securities class action filings have decreased in recent years and, in particular, has fallen nearly 20% from 2011 to 2012. For the number of filings over the past sixteen years can be found below (Figure 2 in their report).

Cornerstone attributes the majority of the decline in class...

SLCG Research: Volatility Smiles from Leveraged ETF Options

(Jan 2013)

Leveraged ETFs are a perennial subject on our blog. I thought I'd take this opportunity to highlight a recent research project entitled "Crooked Volatility Smiles: Evidence from Leveraged and Inverse ETF Options" that I recently completed with my colleagues Geng Deng, Craig McCann and Mike Yan.

While studying options data on leveraged and inverse ETFs, we began to notice a pattern such that deep-in-the-money call options -- contacts whose strike price is well above the current spot price --...